Frequently asked questions

Answers to the top questions we get asked by carriers.

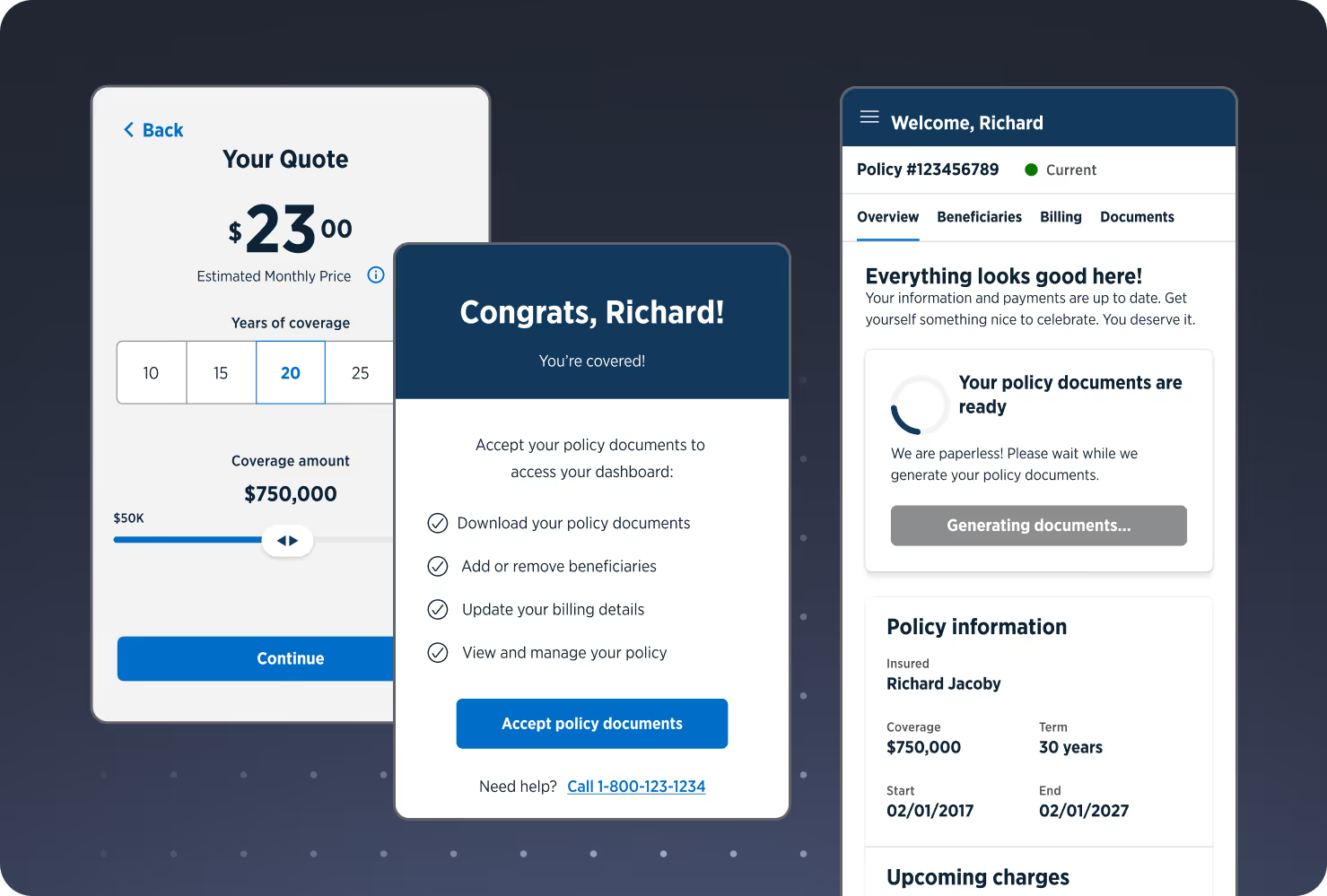

We’re the leading new business and administration technology partner for life insurance carriers looking to modernize efficiently and quickly. We support digital quote, illustration, and application journeys for customers and agents, offer a sophisticated underwriting engine and workbench interface, provide seamless payment, billing, and policy delivery services, and make administration a breeze with portal experiences for customers and support staff alike, as well as full TPA services trusted by top carriers. Our platform supports term life, final expense, IUL, and more — and can be implemented as a full end-to-end or modular solution. This gives carriers the flexibility to modernize in the way that makes sense for their unique needs.

- Carriers looking to modernize parts or all of their business.

- Carriers looking for more efficiency in their underwriting.

- Carriers looking for easily-adoptable agent solutions.

If you’re working in acquisition or administration at a carrier, probably you!

- Expedite growth by streamlining the purchase funnel and eliminating roadblocks.

- Reduce acquisition costs via automation and digitization.

- Unlock new audiences by meeting the modern customer where they are shopping - online.

- Implement rapidly with white-labeled Bestow tech, going live in as little as 4 months.

- Innovate efficiently with product changes in weeks and pricing changes in days.

Yes. You make all the rules, set all pricing, and retain all of your own branding from quote to admin.

Bestow supports, term, final expense, indexed universal life, annuities, and an ever-expanding menu of product options.

Yes. Bestow can build a white-labeled digital application and customer portal experience to keep your customers inside the brand ecosystem they know and trust.

Bestow offers solutions for both D2C and agent-led channels, including giving captive agents and outside distribution teams tools to seamlessly sell remotely, in-person, or via drop ticket.

We pride ourselves on lightning fast time to market. Obviously, timelines depend on partner needs and project specifics, but our partners have been extremely impressed with our development speed. For example, many of the digital insurance products we’ve brought to market took between 6-7 months to develop and launch, far shorter and more cost effective than attempting an in-house build.

Bestow is truly an end-to-end insurance platform. That means we’ve created experiences and entry points for customers, agents, underwriters, administrators, and virtually anyone you can think of in your organization who would need access to, and insights from, the platform.

The short answer is yes. All digital products are built on a consistent framework, but part of our partnership approach is about tailoring digital solutions to meet your unique business needs.

Bestow isn’t a software vendor. We’re a tech partner, not merely a “set it and forget it” solution. It’s true that we've developed bedrock technology, but we pride ourselves on our partnership approach, collaborating with each carrier to help them solve big challenges that are unique to their business.

This depends on the nature and the scale of the change, of course, but timelines can range from hours or days to a number of weeks. Given that many in the industry view product changes as a once-a-year proposition at best, our speed and flexibility really sets carriers up to quickly respond to market forces.

You’ll be supported by teams with all of the key expertise necessary to build and maintain a great product for both agents and customers, with talent from industry mainstays like USAA, Gerber, iPipeline, and AXA. This expertise includes, but is not limited to underwriting and actuarial, compliance and regulatory, product filing, data analytics, tech and UX development, marketing, and so much more.

The short answer is we’re a tech company full of insurance wonks. We marry award-winning technology chops with decades of insurance experience that spans executive leadership, underwriting, compliance, product, and more. This uniquely positions us to help carriers modernize and innovate new products with a speed and fidelity not previously available in the industry.

Yes! Insurance is a complicated industry, and nothing is more frustrating than dealing with a vendor or partner who is learning that after you’ve signed a contract. We’re seasoned pros when it comes to product filing, regulatory requirements, compliance, governance and more. We’ve been at this a while, with tons of expertise and in-market experience to set you up for a smooth launch and sustained success. On top of our vast experience, we also keep up with the latest (and ever-changing) state by state regulations, so our partners can be proactive and ready for anything.

Yes — you can integrate parts of the Bestow Platform into your existing stack. While some components work best as part of the full platform, many key functions are modular and can be deployed independently. This allows you to enhance specific areas (like underwriting, agent tools, or customer servicing) without disrupting your current systems. Reach out to talk to our sales team about how we can build the right offering for your carrier.

No, not necessarily. You may be able to keep the parts of your existing stack that are working and integrate only the Bestow capabilities you need. The platform is designed to work alongside existing systems. Reach out to talk to our sales team about how we can build the right offering for your carrier.

Bestow’s recommendation engine can determine if an applicant is applying for the right-fit product for them, and even redirect them in real time to another product off the Bestow platform, but within the carrier’s portfolio.

Yes, Bestow used to sell term life insurance directly to the consumer under the name Bestow Life Insurance Company, but sold that carrier to Sammons® Financial Group in 2024, who renamed it Lantern Insurance Company. Today, Bestow is a leading life insurance SaaS platform provider.

Sammons® Financial Group purchased Bestow Life Insurance Company in 2024. It was renamed Lantern Insurance Company. Your policy remains in force, and you can access your account here.

.svg)